Markets ebb and flow, you know this if you’ve observed any market for even a day or two.

Markets ebb and flow, you know this if you’ve observed any market for even a day or two.

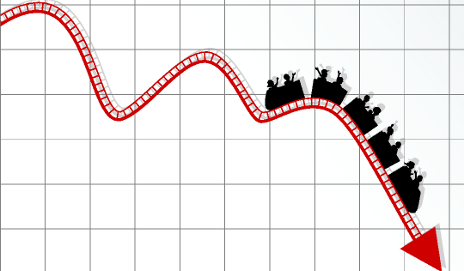

How many times have you found yourself trying to trade intra-day price fluctuations, only to get burned as the dominant daily chart trend resumes and knocks you out of the market? Or, how many times have you exited a profitable trade simply because the market began retracing against your position a little bit, only to then see the trend resume without you on board? These are the type of mistakes that are a result of giving too much relevance and attention to the day-to-day price fluctuations in a market.

Let’s discuss some facts about price action and market dynamics that will help you realize why “less” really is “more” in trading, as well as some ways to avoid giving in to the temptation to find relevance in every ebb and flow in a market.

Fact 1: It’s hard to stop a freight train

Take a look at the recent EURUSD, AUDUSD or USDJPY daily charts right now, you will see long multi-month trends in each of these markets. These are trends with a lot of momentum behind them, and like a freight train, they aren’t going to change direction quickly or easily. Thus, the short-term fluctuations of price against these trends simply don’t matter that much, and there’s certainly no point in getting yourself worked into a frenzy trying to trade them all.

Daily chart trends behave like freight trains because they will move in one general direction sometimes for long periods of time and it takes a big ‘force’ and usually a lot of time to change their direction…

We’ve all heard the old saying ‘The trend is your friend’. Well it’s true. The trend is indeed your friend, unless you try to fight it by trading against it and trying to take advantage of its every little ebb and flow, if you do that, the trend will chew you up and spit you out faster than you can blink. Also like a freight train, a trend can run you over and crush you if you stand in its way. Traders often get in the way of strong market trends by constantly trying to pick the top or bottom and trading against the trend.

If you let yourself give in to the temptation to trade every little price fluctuation within a trending market, you won’t make any money in that trend. Trends are the best time to trade because they offer the highest-probability trading opportunities, so you want to be sure you’re properly taking advantage of their power by only trading WITH them and not trying to trade every little ebb and flow against them. You don’t want to get crushed by a ‘freight train’ do you?

Fact 2: Losing money DEY VEX PERSON

If you asked anyone on the street, “Do you like losing money?” they would all respond with a resounding “NO”. Yet, if you put 10 people in front of a trading platformA and tell them a little bit about trading, 9 of those people are going to sit there and look at all the little intra-day market fluctuations, probably on every time frame possible. They will do this EVEN if you tell them it’s going to cause them to lose money. Thus, it’s ironic that no one wants to lose money, yet many people trade in a manner that shows they apparently do want to lose money.

Losing money sucks. I hate it. You should too. Therefore, as a trader, your number one goal should be capital preservation, aka, not losing money. The easiest and surest way to not lose money in the market, is to simply avoid looking at, trading or even thinking about every little price fluctuation in the market. You simply cannot trade them all and most of them are meaningless. You need to eliminate the temptation to sit in front of your computer for hours staring at charts, trying to find a trade. By understanding a couple key things, you can do reduce or eliminate this temptation:

- The best trade setups are obvious. It doesn’t take a genius to spot them. If you are sitting there struggling to find a trade, then there’s not one worth risking money on! Walk away! Save your money! If you like your money, you will not lose it by trading when there’s simply nothing worth trading. Otherwise, go ahead and gamble your money away and lose it all if you like.

- You make money in the market by preserving your capital (not trading) when there’s no reason to trade so that you have more money to trade on good trade signals. You need to realize that not every price movement in the market is meaningful, in fact most are meaningless. Learn an effective trading method like price action strategies, master it, and then you will know what to look for in the market. It’s then up to you to have the discipline and patience to act only when your trading strategy is telling you to. But if you sit there for hours staring at the charts and trying to make sense of every little price fluctuation, you will for sure lose money, and we all agree that losing money sucks.

Fact 3: The long-term dictates the short-term

If you have a multi-month trend like the recent EURUSD down trend we saw in the chart above, short-term price movements to the upside are highly unlikely to last very long. Thus, the long-term trend dictates the short-term price movement.

This is a huge ‘clue’ that we can use as price action traders to put the odds in our favour. It allows us to develop a market bias and then only look for signals in-line with that bias. You can then ignore counter-trend price fluctuations, and instead focus only on trading with the trend. Many traders attempt to trade every little move in the market; they think they can trade every counter-trend retrace, but that never works.

You never know how long a counter-trend move will go, and usually they are a lot quicker than we expect, this is partially what makes trying to trade them so difficult.

In summary, the facts that a strong trend behaves like a ‘freight train’, losing money sucks and the long-term dictates the short-term, are big reasons why short-term market fluctuations are almost irrelevant.

No comments:

Post a Comment